The FCA have updated their analysis on MLTM risk. Firms need to continue to review their systems, controls, MLTM awareness and training.

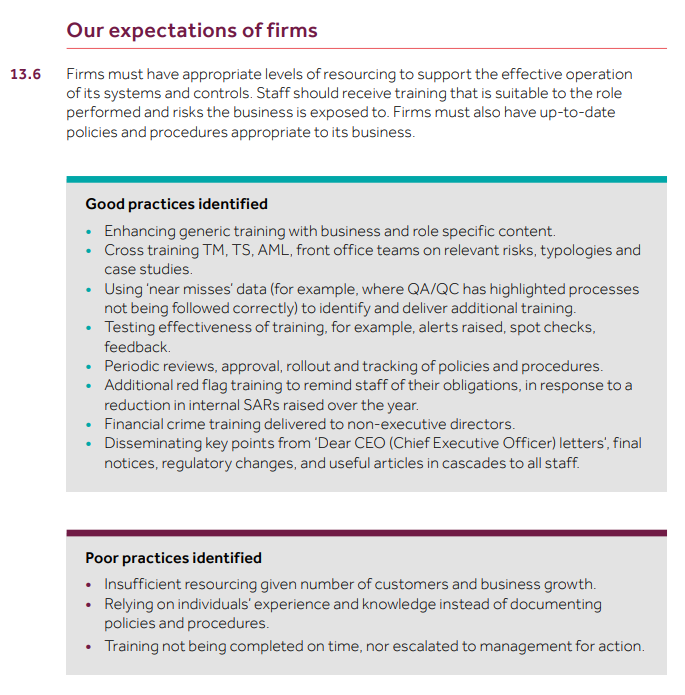

Chapter 13 of the FCA’s January 2025 ‘Assessing and reducing the risk of Money Laundering Through the Markets (MLTM)’ report provides details on good and poor practice, e.g., ‘proactive firms tailored training content to their business model, related risks, common red flags and for the different roles in the firm.’

We’re helping firms overcome many of the challenges identified from the guidance in relation to improving, personalising and quantifying the effectiveness of staff training (see key points from FCA guidance below).

How Clever Nelly can help…

With the FCA placing increased emphasis on how firms are evidencing the effectiveness of their financial crime training programmes, John Clarke, MLRO at Fidelity International, discusses why they are using employee-centric AI to embed regulatory learning at scale and demonstrate sustained employee competency to the highest regulatory standard.

Read our case study (below) to discover:

- How Clever Nelly provides best-in-class evidence of regulatory adherence to staff training requirements under UK Money Laundering Regulations.

- How Fidelity use real-time MI to measure financial crime training effectiveness, identify training needs and mitigate regulatory risk.

- How Clever Nelly is used to improve, maintain and evidence ongoing competence of staff undertaking key financial crime roles – using less than one minute of an employee’s working day.